During the cryptocurrency market’s downturn last year, Hong Kong regulators found reason to commend themselves. Their well-judged caution and step-by-step strategy, which has been in the making since 2017, in shaping regulations for cryptocurrency trading, helped the city avoid potential damage to its reputation.

FTX was based here, got annoyed with our perceived tardiness, dabbled in regulatory arbitrage and fled to the Bahamas in 2021, where it subsequently imploded to unveil a monumental fraud.

The Securities and Futures Commission has put up guard rails but Hong Kong still lacks a cohesive education and protection ecosystem to underpin the regulation

Singapore’s reputation was smeared, after already suffering from the collapse of Three Arrows Capital and Do Kwon’s algorithm-based Terra and its native token, Luna. Temasek Holdings, the gold standard of astuteness, had to write off US275 million after putting Singapore’s sovereign wealth in FTX.

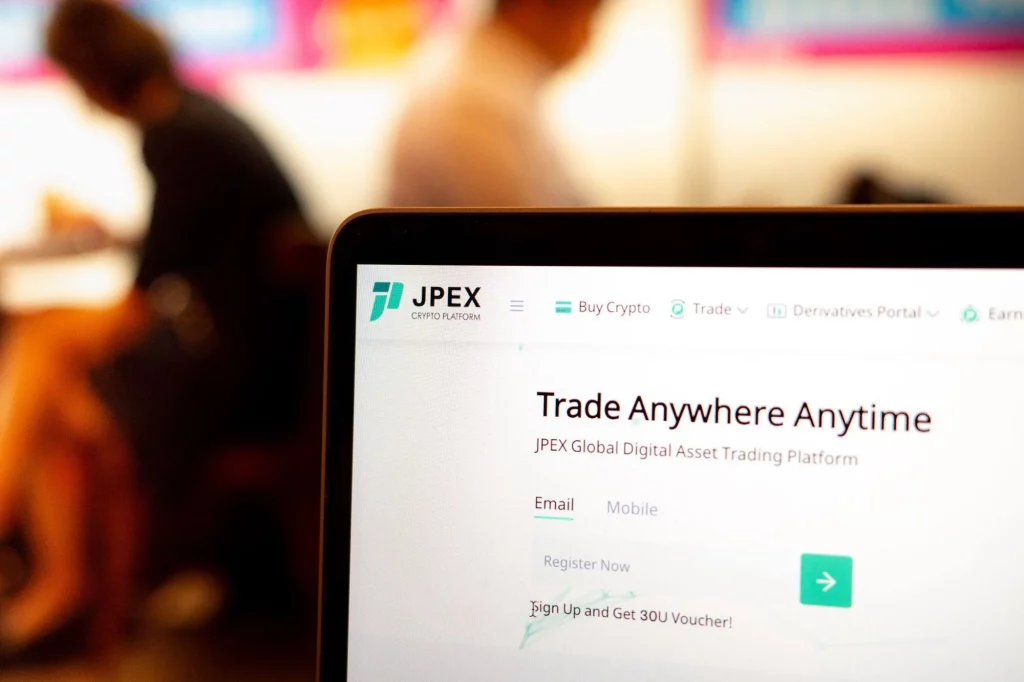

With Singapore’s cryptocurrency ambition on the ropes and Dubai’s intentions explicit, Hong Kong entered the fray. The government was lobbied to open up the licensed market to retail investors, to prevent unsophisticated traders from using unlicensed or overseas exchanges and being exploited. This was what happened with JPEX, the unlicensed cryptocurrency platform accused of scamming investors.

There have been official noises about investor education and protection. But it’s debatable whether greed can be legislated away when saturation marketing and social media influencers have so much more immediacy. Singapore tried and banned cryptocurrency promotions.

Hong Kong’s Securities and Futures Commission (SFC) has put up guard rails for retail investors but we still lack a cohesive education and protection ecosystem to underpin the regulation. Such a ecosystem would unify the police, SFC, the monetary and customs authorities, the cryptocurrency lobby, banks and, crucially, the public as citizen vigilantes.

Hong Kong’s average Joes are adept at spotting the hottest new cryptocurrency promotions, whether from banner ads in MTR stations or on social media, and finding the latest over-the-counter (OTC) cryptocurrency outlets – which, in the case of JPEX, neither the SFC nor the monetary or customs authorities appeared to have much, if any, jurisdiction over.

Regulators reportedly did not know exactly how many of such OTC outlets operate in Hong Kong. This is despite the police regularly disseminating text messages warning of email scams and the Hong Kong Monetary Authority’s anti-fraud task force.

In a borderless cryptocurrency world, real-time warnings are vital. Every cryptocurrency investor in Hong Kong should be encouraged to register with the agencies above. Ideally, this would be done through a one-stop, bilingual, user-friendly SFC website dedicated to digital asset investment.

Such a website should contain updated investor alerts, licence status lists, copies of the licences granted, the names of the directors and banks, lists of reported and known cryptocurrency scams via a “red flag list”, what can be said in promotional materials, and whistle-blower phone and email hotlines with guaranteed response times.

There should also be law firms, accountants and blockchain forensic analysis companies that can be instructed, and a retail and institutional investor crisis management checklist – for when investors realize they have been scammed, their wallets hacked or their data breached.

Gullibility can also be weakened through bilingual education seminars by speakers in the Web3 ecosystem that are sponsored by authorities such as the SFC.

In a pseudonymous, decentralized cryptocurrency world, the public’s access to data for education and enforcement may have to be centralized if Hong Kong seeks to become a global cryptocurrency hub.

A tough question is which is more important: an investor’s right to withdraw and redeem at will, or the maintenance of the exchange’s liquidity? These appear mutually exclusive. Sometimes, however, an exchange operating within the rules may have legitimate reasons to temporarily gate investor withdrawals that have nothing to do liquidity issues.

It was different with JPEX, which admitted to a liquidity problem. As the police and the SFC closed in, JPEX’s cynicism towards its clients went on full display. It effectively halted withdrawals by imposing a prohibitively high handling fee of over 90 per cent and started a process to turn the platform into a decentralised autonomous organisation with deferred dividends.

To retail investors with frozen funds, this was a coerced Ponzi scheme. Given that JPEX was based in Dubai, a centralized Hong Kong early warning system might have produced results as to the status and whereabouts of funds.

JPEX is accused of never intending to be regulated or licensed in Hong Kong and of ignoring the SFC’s enquiries – a charge it denies. While JPEX had been on the SFC’s radar since March last year and was placed on its alert list four months later, there seemed to be little the SFC could do except liaise with the police, which finally asked internet service providers to block the JPEX website last month.

By June 1, 2024, Hong Kong-based cryptocurrency exchanges must apply for a licence or shut down. Perhaps the SFC should reserve the option of “regulatory sandboxes” in the meantime to test its requirements for virtual asset trading platforms and ensure compliance, before unleashing such platforms on an unsuspecting public.

While the JPEX scandal is the city’s largest case of financial fraud, it won’t derail Hong Kong’s cryptocurrency and Web3 ambitions, which are entrenched government objectives. With Hong Kong’s FinTech Week approaching, we can expect the government to reiterate its commitment to Web3 and to stress its ethical development.

It is better for the SFC to learn its cryptocurrency lessons sooner rather than later. The commission had the backing of Web3 players when it decided to disclose the list of applicants for virtual asset licensing and their status in the wake of the JPEX fallout. Now the real work of investor education begins.

This Article was Written by Sanjeev Aaron Williams (Hong Kong-based lawyer who writes on geopolitics and the digital economy)

Leave a Comment